Carbon Management Disclosure and Firm Value in the Nigerian Energy Market

DOI:

https://doi.org/10.71113/JCSIS.v2i7.333Keywords:

Construction Management, Firm Value, Share PriceAbstract

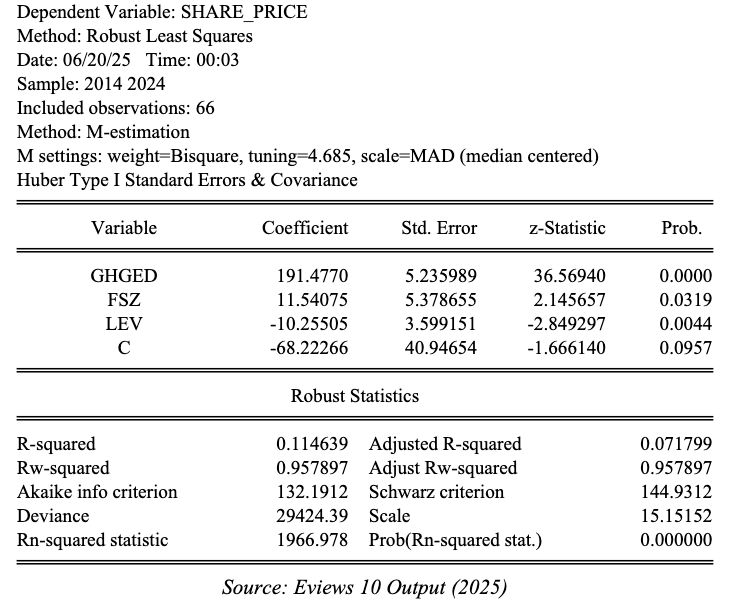

The absence of robust carbon disclosure mechanisms undermines investor trust, increases information asymmetry, and weakens market efficiency. Nigerian energy firms may inadvertently appear less competitive or unattractive to international investors who prioritize sustainable environmental performance. Hence, the study investigated the extent to which carbon management disclosure influences firm value in the Nigerian energy sector. Ex-post facto research design was adopted in the study. All the nine listed energy firms in Nigeria made up the population of the study. Purposive sampling was used to select the sample size of six. Secondary data were collected from the annual reports of the firms over an eleven year period from 2014-2024. The data collected were preliminarily analysed using descriptive analysis, test of autocorrelation and test of heteroskedasticity. Robust least square regression was used to test the hypothesis. The study found that carbon management disclosure (proxy by greenhouse gas emission disclosure) has a significant positive influence on firm value (proxy by share price) in the Nigerian energy sector (β = 200.5120, p = 0.0000). In conclusion, in today’s capital markets, transparency in carbon management is no longer peripheral—it is central to value creation, reputation management, and sustainable corporate performance. We recommend that the Nigerian Securities and Exchange Commission (SEC), in collaboration with the Financial Reporting Council of Nigeria (FRCN), should institutionalize a mandatory and standardized framework for greenhouse gas emission disclosure among listed energy companies.

Downloads

References

Adekanmi, A. D., Aduwo, A. E., Alabi, S. A., & Falusi, I. E. (2024). Carbon Management and Wealth Maximization of Listed Financial Services Firms in Nigeria. The Journal of Accounting and Management, 14(2), 7-19.

Agbo, E., Uchenna, U., & Achema, F. (2024). Greenhouse gas emission and energy consumption disclosure on market competitiveness of listed non financial firms in Nigeria. Igwebuike: African Journal of Arts and Humanities, 10(3).

Barney, J. B., Ketchen Jr, D. J., & Wright, M. (2011). The future of resource-based theory: revitalization or decline?. Journal of management, 37(5), 1299-1315.

Bastian, B., Richter, U. H., & Tucci, C. L. (2018). Natural resources and the resource-based view. In Managing natural resources (pp. 186-210). Edward Elgar Publishing.

Ding, D., Liu, B., & Chang, M. (2023). Carbon emissions and TCFD aligned climate-related information disclosures. Journal of Business Ethics, 182(4), 967-1001.

Eboh, M. (2025, January 30). Nigeria lost N1.7trn to gas flaring in 2024. Sweetcrude Reports. https://sweetcrudereports.com/nigeria-lost-n1-7trn-to-gas-flaring-in-2024/

Fawzyputra, V. R., Dewi, V. S., & Pramita, Y. D. (2025). Carbon Emissions on Firm Value: Evidence from Energy Sector Companies in Indonesia. In E3S Web of Conferences (Vol. 622, p. 02013). EDP Sciences.

Gharaibeh, A. M. O., & Qader, A. A. A. A. (2017). Factors influencing firm value as measured by the Tobin’s Q: Empirical evidence from the Saudi Stock Exchange (TADAWUL). International Journal of Applied Business and Economic Research, 15(6), 333-358.

Habibullah, M. D., Mukhzarudfa, M., & Friyani, R. (2025). The Effect of Carbon Emission Disclosure and Environmental Performance on Company Value in Indonesia (Empirical Study on Mining Companies Listed on the Indonesia Stock Exchange 2021-2023). East Asian Journal of Multidisciplinary Research, 4(2), 683-694.

Koller, T., Goedhart, M., & Wessels, D. (2010). Valuation: measuring and managing the value of companies. John Wiley & Sons.

Lonkani, R. (2018). Firm value. In Firm Value-Theory and Empirical Evidence. IntechOpen.

Luo, L., & Tang, Q. (2023). The real effects of ESG reporting and GRI standards on carbon mitigation: International evidence. Business Strategy and the Environment, 32(6), 2985-3000.

Maharani, D., Puspita, I., Suhaimah, K., & Saadah, K. (2024). Carbon emissions disclosure and firm value: A study of firms in Indonesia. International Journal of Academe and Industry Research, 5(3), 22-45.

Njoku, K. C., Ndifon, J. I., & Apaingolo, E. G. (2025). Petroleum industry and the Nigerian economy. Scholarly Journal of Social Sciences Research, 4(1), 1–15. https://doi.org/10.5281/zenodo.14769002

Nwokeogu, P. C., Okafor, T. G., & Okafor, O. O. (2024). Carbon management and financial performance of quoted Oil and Gas firms in Nigeria. Journal of Global Accounting, 10(4), 121-141.

Nworie, G. O., & Okafor, T. G. (2023). Nigeria Public Manufacturing Firms adoption of Computerised Accounting System: The Firm Size and Firm Capital Turnover Effect. Journal of Global Accounting, 9(1), 324-345.

Nworie, G. O., & Orji-Okafor, T. G. (2024). Quadruple bottom line disclosure among listed manufacturing firms in Nigeria: A paradigm for cost savings. International Journal of Management, Accounting and Economics, 11(10), 1416-1437. https://doi.org/10.5281/zenodo.13910231

Nworie, G. O., Cyril-Nwuche, O. F., & Oduche, I. J. (2024). Legitimacy gains from environmental cost: Effect on share prices of Nigerian ICT firms. Journal of Accounting and Financial Management, 10(6), 219-231. https://www.iiardjournals.org/get/JAFM/Vol%2010.%20No.%206%202024/Legitimacy%20Gains%20from%20Environmental%20219-231.pdf

Nworie, G. O., Okafor, T. G., & John-Akamelu, C. R. (2022). Firm-level traits and the adoption of computerised accounting information system among listed manufacturing firms in Nigeria. Journal of Global Accounting, 8(3), 128-148.

Obafemi, O. T., & Oyedepo, F. O. (2024). Carbon Accounting And Performance Of Emerging Firms In Nigeria. ANUK College of Private Sector Accounting Journal, 1(2), 250-255.

Okafor, O. O., Nworie, G. O., & Onyebuchi, M. H. (2024). Assessing Financial Returns Through Environmental Responsibility Disclosure Among Listed Oil and Gas Firms in Nigeria. International Journal of Research Publication and Reviews, 5(4), 545-557. https://doi.org/10.55248/gengpi.2023.42001

Okike, C. O., Nwachukwu, I. G., & Agbiogwu, A. A. (2024). Emission disclosure and market value added of oil and gas firms in Nigeria. African Journal of Social and Behavioural Sciences, 14(6).

Okonkwo, O. (2022, November 25). Nearly 65% of Nigeria’s CO₂ emissions are connected to energy consumption. Nairametrics. https://nairametrics.com/2022/11/25/nearly-65-of-nigerias-co2-emissions-are-connected-to-energy-consumption/

Olawale, O. (2023). Firm-value effects of carbon emissions and carbon disclosures: evidence from Finland (Master's thesis, O. OLAWALE).

Orjinta, H. I. P., Okafor, J. I., & David, U. (2024). Carbon emission and performance of quoted oil and gas companies in Nigeria. African Journal of Environment and Sustainable Development| ISSN, 3027, 2718.

Permata, I. S., & Alkaf, F. T. (2020). Analysis of market capitalization and fundamental factors on firm value. Journal of Accounting and Finance Management, 1(2), 59-67.

Pitelis, C. N. (2004). Edith Penrose and the resource-based view of (international) business strategy. International business review, 13(4), 523-532.

Sun, W., Chen, K., & Mei, J. (2024). Integrating the Resource-Based View and Dynamic Capabilities: a Comprehensive Framework for Sustaining Competitive Advantage in Dynamic Markets. EPRA International Journal of Economic and Business Review, 12(9), 1-8.

Triasma, C., & Sari, R. (2025). The impact of carbon emission disclosure on corporate reputation and financial performance. Jurnal Manajemen Perbankan Keuangan Nitro, 1(3), 13-24.

Utomo, M. N., Rahayu, S., Kaujan, K., & Irwandi, S. A. (2020). Environmental performance, environmental disclosure, and firm value: empirical study of non-financial companies at Indonesia Stock Exchange. Green Finance, 2(1), 100.

Worldometer. (2023). Nigeria CO₂ emissions. https://www.worldometers.info/co2-emissions/nigeria-co2-emissions/

Xie, H., Qin, Z., & Li, J. (2024). ESG performance and corporate carbon emission intensity: based on panel data analysis of A-share listed companies. Frontiers in Environmental Science, 12, 1483237.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Joseph Ogwu Elom, PhD, Gilbert Ogechukwu Nworie , Dr. John Okereke Ugwu, Dr. Justin E. Nwogo, Dr. Anamelechi Ogai Nwele

This work is licensed under a Creative Commons Attribution 4.0 International License.